Unlock Opportunities with Borderless Payments

A bespoke digital FX and payments solution that offers businesses a quick, secure and easy to use treasury service; all at low cost. Whether it’s a single transfer or your international payroll run, IFX Payments will streamline your operations to save you time and money.

Payment Solutions

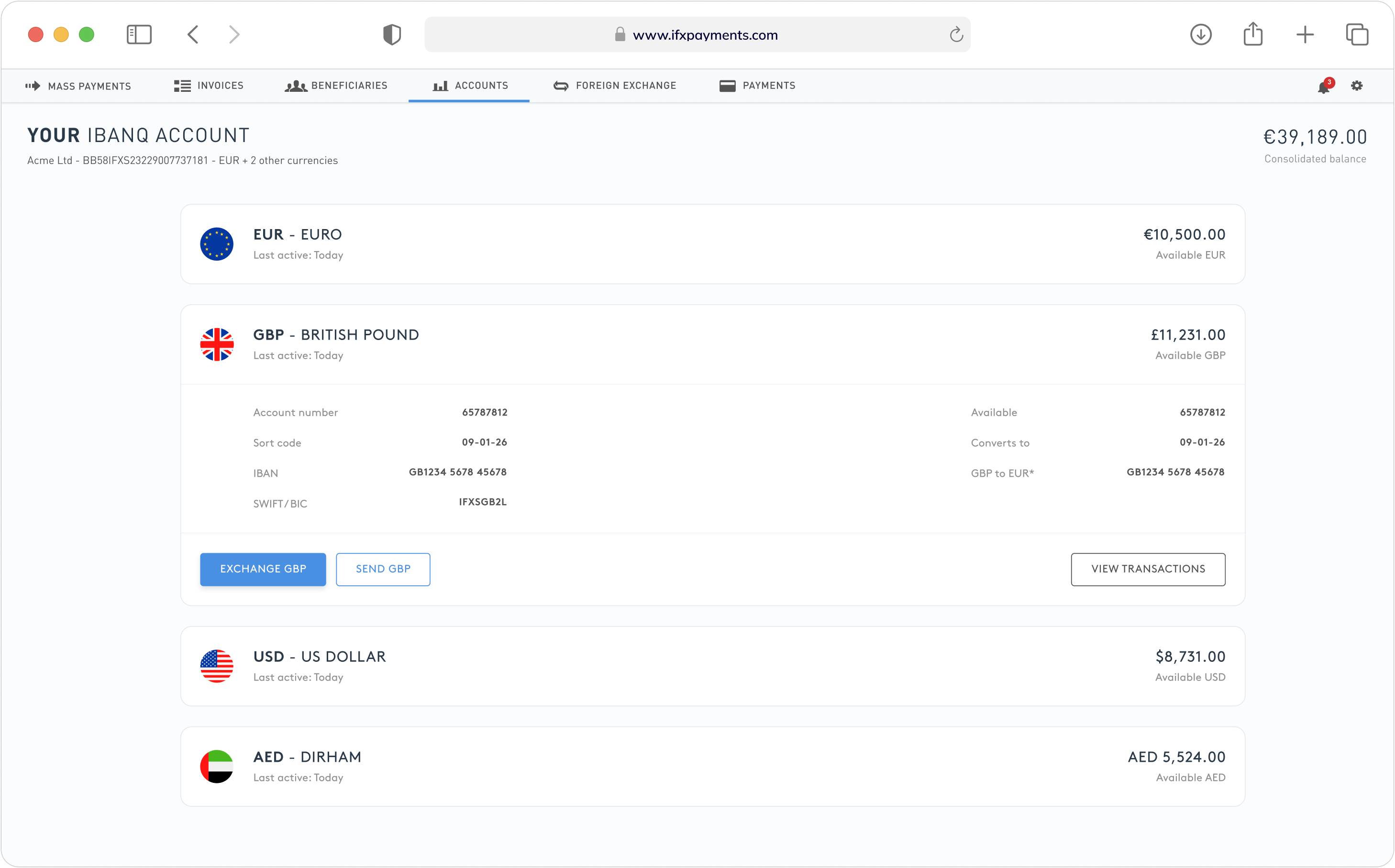

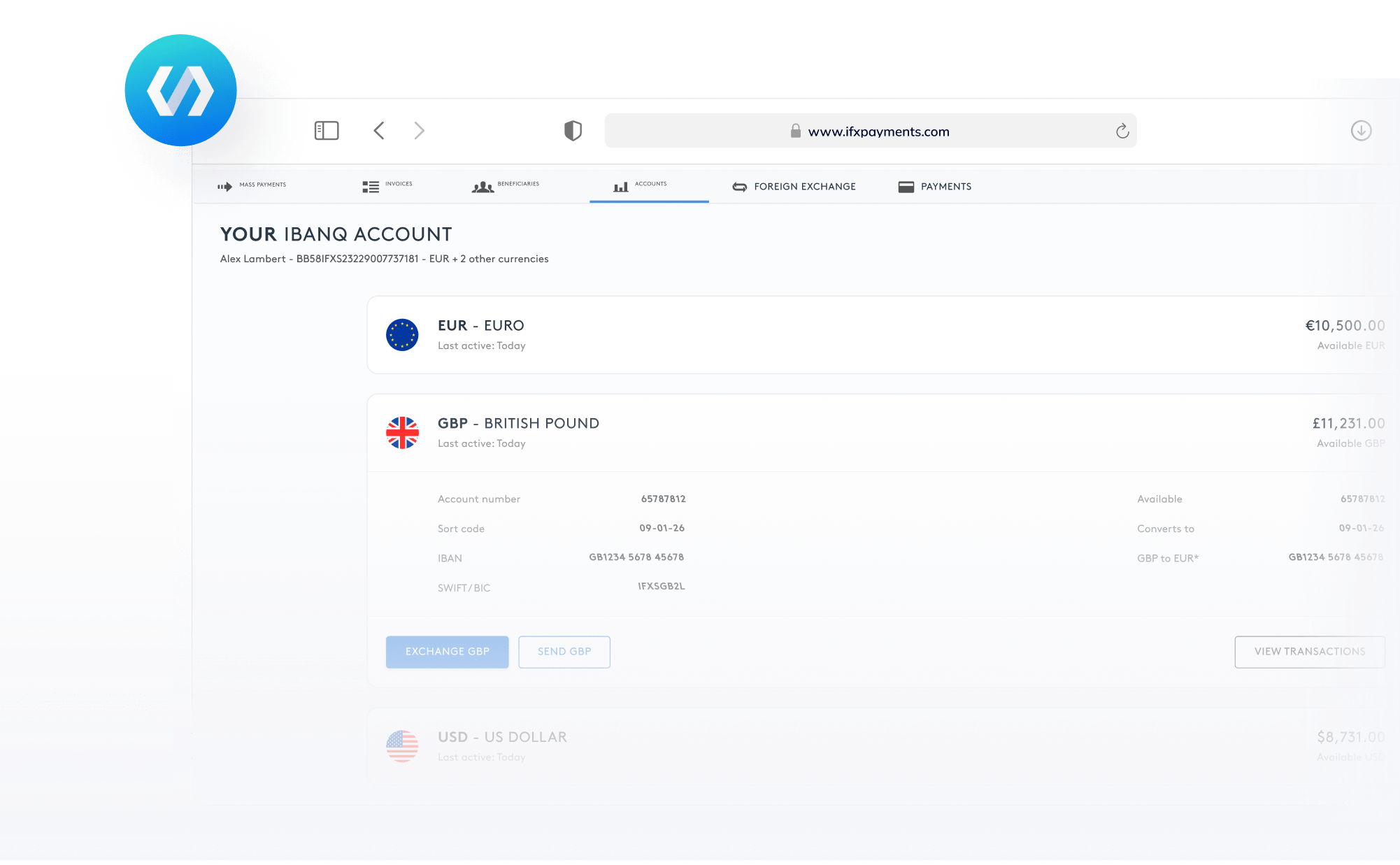

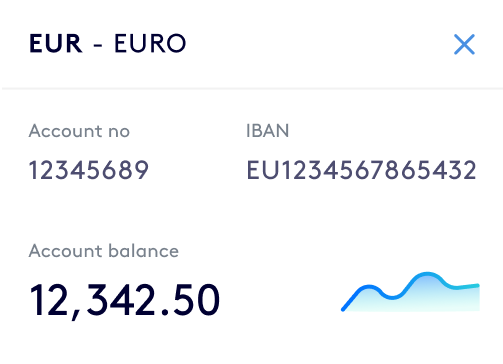

Access a range of domestic and international payment and currency capabilities through our digital treasury management solution - ‘ibanq’. Built with customisation at its heart, ibanq can be tailored to suit the unique needs of your business. In one simple, easy to use platform, businesses can access:

• Multi-Currency Collection Accounts

• Cross-Border Payment Routes

• Mass Payments Capabilities

• Currency Hedging Solutions

Foreign Exchange

For those seeking a more hands-on approach, our foreign exchange services cater to both corporate and private clients. Our dedicated currency experts will work closely with you to craft bespoke solutions that align with your goals and market conditions.

Discover FX

Industry recognition

Recognised by respected industry bodies, our service-led approach and forward-thinking solutions are helping businesses thrive in global markets.

What Partners and Clients Say About Us

Our Partners

Latest News & Insights

2 January 2025

2 January 2025

Market recap: December 2024

Our monthly summary of the key events that influenced FX markets in December 2024.

26 November 2024

26 November 2024

IFX Payments appoints Adam Dowling as Chief Operating Officer

In his role, Adam will help drive operational efficiency, manage risk and optimise performance across day-to-day operations and strategic growth initiatives.

8 November 2024

8 November 2024

Market recap: October 2024

Our monthly summary of the key events that influenced FX markets in October 2024.